CBDC will weaken Banks as we know..

Indian central bank, RBI announced the pilot of CBDC in India in Nov 2022 for wholesale and in early December 2022 announced the pilot of CBDC for retail. This was anticipated for sometime and many other countries have also initiated CBDC and are at various stages of adoption, from policy drafting to development to pilot to launch. This is a BIG move and many pundits have detailed the benefits and challenges of CBDC globally, here is an effort to identify some of the impacts of CBDC on Banks and Financial institutions. In here, I have kept this largely to India context, the impact will be similar to any of the Banks across the globe with CBDC becoming a reality.

Dual Tokens Economy

With CBDC, India, will anyway gear upto be a multi token economy with Rupee (Physical currency) and E-Rupee (Digital Currency). Perhaps this is how it will be across most of the countries globally. A few countries will be multi tokens economy with Physical currencies, Digital Currencies and Cryptocurrencies. While, the benefits have already been talked about by many, I will focus on what seems to be left out in the narrative so far.. wondering if its deliberate though??

The Indian banking system

consists of 12 public sector banks, 22 private sector banks, 44 foreign banks, 43 regional rural banks, 1,484 urban cooperative banks and 96,000 rural cooperative banks in addition to cooperative credit institutions. As of September 2021, the total number of ATMs in India reached 213,145 out of which 47.5% are in rural and semi-urban areas. One of the first casualty's of CBDC will be ATM suppliers. They will not have more orders coming and rather even the service revenue will start declining. Needless to say the (money) Cash management companies will be facing the heat much sooner.

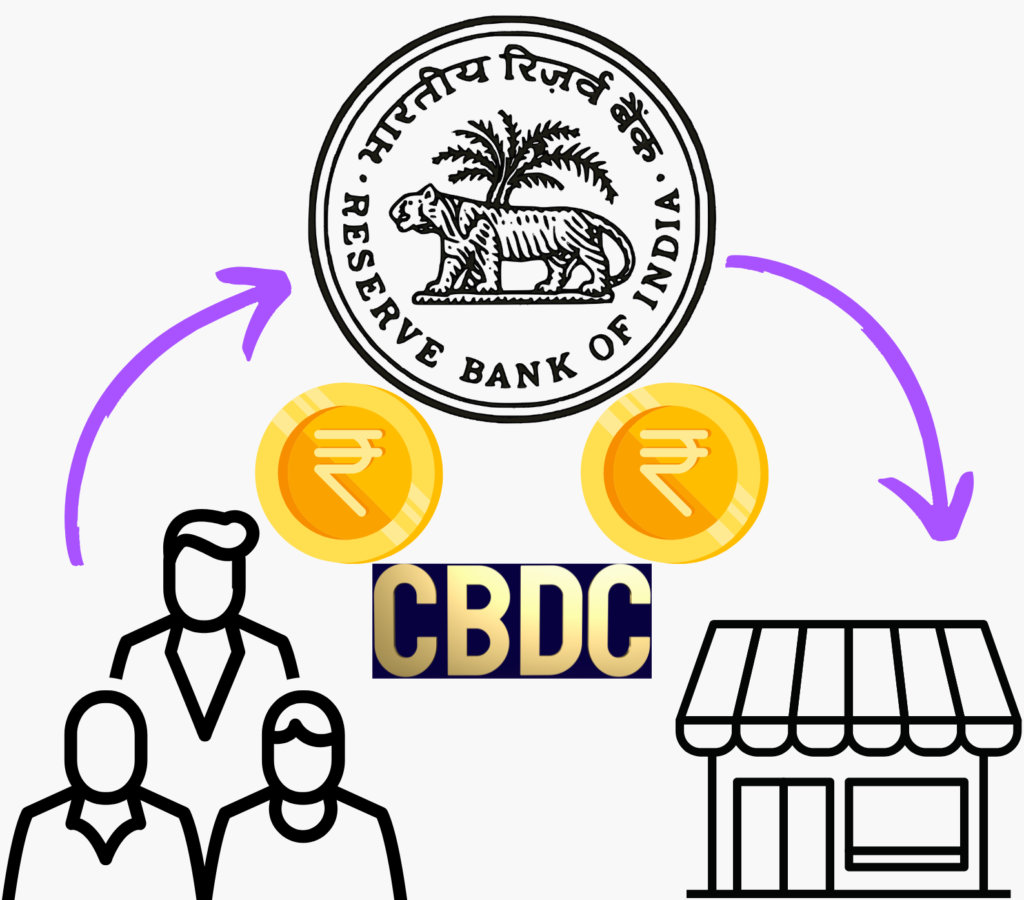

Role for Banks?

As you can see the illustration, In retail transactions, CBDC just displaces the Banks. Till date, or presently, all the money flow happens through the Banks we all hold our moneys in. But, with CBDC, much of the money movement starts happening without Banks, between people (Customers) and Institutions (Service providers). Do you realise the implications of this? What could be revenue loss for these giant Banks?

Cross border payments

International remittance to India is nearly $100 billion in 2022. Much of this is coming through Banks and there are companies living out of this remittances also. In the next couple of years, this will not be reflecting on any or most Banks books. As, people will send money to the relatives account directly through CBDC, via RBI. Perhaps Banks and other financial services companies may attract these monies for other investment products but the loss of revenue for transfer service will hurt the banks while leading to shut down of the companies living out of remittances unless they reinvest themselves.

Savings bank Account

Average SB Account holding amount to 22% of the Banks total cash handling as per RBI in 2021. CBDC will have a significant impact on this component, where in majority of the people (Citizens / customers) may choose to keep the liquid components in their "E-Wallets", which essentially supported by the central Banks (RBI). This is not only a significant component, this will further hurt the "Custodial Banks" and their services and their revenue vis-á-vis earnings. Along with Current account, CASA (Current Account - Savings Account) form the cheapest source of capital for Banks and these will get affected in a significant manner.

Small Businesses in India

- Number of SMEs in India: The number is estimated to be at 42.50 million, registered & unregistered together. A staggering 95% of the total industrial units in the country.

- SME & Employment opportunity: Employs about 106 million, 40% of India’s workforce. Next only to the agricultural sector.

- Products: produces more than 6000 products.

- GDP Contribution: Currently around 6.11% of the manufacturing GDP and 24.63% of Service sector GDP.

- SME Output: 45% of the total Indian manufacturing output.

- SME Exports: 40% of the total exports.14.8 Lac registered active companies in India by June 2022 refers that many active accounts with the Banks as on that date.

Each of those components will have a touchpoint with CBDC, which are bound to help the small businesses and even consumers. Question here is, how much of Bank's revenues and earnings will disappear from here on that account?

Further impact of CBDC on Banks

As of June 01, 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totalled Rs. 1.68 trillion (US$ 21.56 billion). Microfinance industry’s gross loan portfolio (GLP) by 10% in FY22 to Rs. 2.85 trillion (US$ 36.42 billion). Each of these are bound to be significantly impacted by CBDC. Consumers or customers are not the affected parties here, its the Banks that are likely to face the heat because they are the intermediaries for all of these money movements, which get significantly impacted and could lead to these giant institutions shrinking. Most of us will see this in our times.

Further impact of CBDC on Banks

As of June 01, 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totalled Rs. 1.68 trillion (US$ 21.56 billion). Microfinance industry’s gross loan portfolio (GLP) by 10% in FY22 to Rs. 2.85 trillion (US$ 36.42 billion). Each of these are bound to be significantly impacted by CBDC. Consumers or customers are not the affected parties here, its the Banks that are likely to face the heat because they are the intermediaries for all of these money movements, which get significantly impacted and could lead to these giant institutions shrinking. Most of us will see this in our times.

Grants and schemes for small Businesses in India

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), Pradhan Mantri Mudra Yojana (PMMY), Credit Support Scheme, Marketing Support Scheme, Credit Linked Capital Subsidy Scheme for Technology Upgradation (CLCSS), Stand-up India Scheme across categories such as Women, Backwards minority, rural, etc., Lean Manufacturing Competitiveness For MSMEs, Government Subsidy for Small Business for Cold Chain, Integrated Development for Leather Sector Scheme, Technology and Quality Upgradation Support (TEQUP) Scheme, Integrated Processing Development Scheme (IPDS) are among the top schemes from Government and all of them have touch points with Banks currently. Some of them are executed by Banks only, while others are executed by other institutions and facilitated by Banks. This will also change significantly.

Rich and Influential banking families

There have always been men who were wealthy and those men were not only wealthy in comparison to their peers, they were wealthy to the extent of being lenders to rulers of states and they extended influence beyond the states and geographies they lived in and beyond the influence of one or more rulers.

Then there were families for generations like Welser family, who influenced the history across Europe and modern Americas. Families, who started lending money to Businesses and even governments and even Banks, such names are familiar to many of us as; Rothschild, Grandly, Goldman-Sachs, Liechtenstein, Coutts, Hoare, Barrenberg, Metzler, and such continue to run Banks and financial institutions that not only determine the global businesses but also policies to great extent. Today, anybody may put together an all new list drawn out of the wealthiest people's list and each are capable of doing pretty much the same. But, CBDC will take power out of such to a great extent.

Other risks

Governments run by Politicians and bureaucrats will have a control that was last known only in the times of Monarchs or colonial days, which the good majority of us have moved on from. We do associate this with other countries which are run by Monarchs or ruling families or Autocratic/authoritarian ruled countries across the globe. Risk is, this kind of control over money could make a democratically elected government also become more authoritarian. History has shown us that those who control or influence faith, money or community (driven by Nationalism) can take control of the whole state.

Solution

- We need higher accountability at every level of bureaucracy.

- We need better political awareness across the citizens

- Towards which, we need better education system to cover every citizen

- To ensure that, we need better compliances across Sectors.

- For that, we need transparent administrators and independent public institutions, which are independent of Government machinery.

- All of these are possible if Citizens truly become more participative.

While, RBI is leading major changes, the leadership at RBI is still to come to terms with the changing dynamics of the world. Lets see these very statements from the Governor of RBI,

Next financial crisis will come from Private Cryptocurrency; Is this a suggestion that CBDC will evolve to be the Public Cryptocurrency(Since it is centralised)?? As much as any (Fiat)money can be used for fraud or illegal activities or personal gains by the people including those running government (as Politicians and / or Bureaucrats) so can Cryptocurrencies can be used. That is where the expectation of proper regulations come from.

After FTX episode..; What does that even mean? FTX episode was a clearcut FRAUD. He for one should very well know, we have had an exactly similar event over a decade ago with Satyam Computers right here in India. Also, FTX was very much a centralised exchange. These kind of rhetorics only contributes to confusion in the mind of people which is leading to many Web 3.0 ventures moving out of India.

Lastly..

Purpose of trying to highlight the possible threats to Banks is not to undermine the impacts of CBDC. I sincerely believe, CBDC is most needed and will have a significant positive impact on the people as consumers and for businesses as well.

I urge Bankers to look at this as an opportunity to re-invent themselves. As, this will open up a huge opportunity for Boutique financial services companies, NBFC's, and Fintech companies to compete far more aggressively in the domains otherwise dominated by Banks. Many of the Institutions who were playing second fiddle to the banks will find themselves in a position comparable to the adage "Tail wagging the Dog".

Banking is a very good business if you don't do anything dumb. - Warren Bufett

Unfortunately, the above statement is partially correct. Times are disruptive, but you have a heads-up. BlockChain, Web 3.0, and CBDC are not only threat, they can be much bigger opportunities for you. You as a Banker perhaps have another two to three years to look at redefining your future. You could drive into the Sun set or the Sun Rise. What do you choose?

I acknowledge the fact that referring to Purandara Dasa among the absolute capitalists in the context of the argument as a whole may appear to be lopsided. But, I captured it while trying to be optimistic that world is waking up to the reality of giving and also trying to recognise that one who receives is greater than one who gives. Still, if it upsets anyone, that is not my intension and I apologise for that.